You are so full of shit.....that surplus went to paying down the debt...a total of 10 billion last year...get your facts straight.

Yes he cut taxes, why shouldnt he, when we have such high surplusses year after year maybe it is time for tax cuts but I bet you would be the first guy to bitch if he raised taxes.....just like a true Liberal.

Anyway...

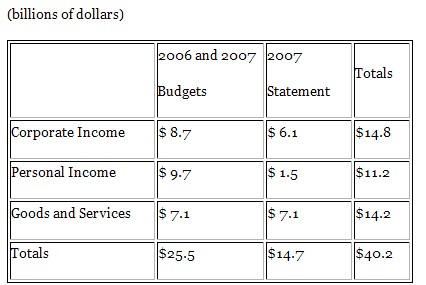

On the corporate side, for example, $6.1 billion is the cost of cutting from the previously-budgeted rate of 18.5% to 15%. However, $14.8 billion is the full cost of going from the current rate of 21% all the way down to 15%, chopping a point off the small-business rate, and eliminating the corporate surtax.

Almost all of the corporate-income-tax cuts from Budget 2006 and some of the personal-income-tax cuts from Budget 2006, Budget 2007 and Statement 2007 were cribbed from the Liberals’ 2005 Budget and Economic Update. The GST cut was an “all Conservative” initiative that the Liberals sort of opposed, but probably would not reverse.

The pie chart on page 72 of the Statement, which received significant currency in the press, suggests that the GST cut predominated and that corporate tax cuts were the least expensive part of the program. This picture is based on summing the six fiscal years from 2007-08 through 2012-13.

The two-point GST cut looks bigger because it will be fully implemented in 2008, whereas the corporate cuts will continue through 2012. However, the annual cost of the corporate cuts will ultimately exceed that of the GST cut. In other words, the program is less populist and more favourable to Bay Street than most reports implied.

Surpluses and hence debt repayment could still exceed official expectations. If so, the Tax Back Guarantee enacted in Budget 2007 ensures that personal-income-tax cuts will be costlier than projected.

When fully implemented, all of the Conservative tax cuts will cost more than the Canada Health Transfer and the Canada Social Transfer combined. Table 2.5 (page 56) projects that “federal transfers in support of health and social programs” will be $40.1 billion in 2012-13.

Had the federal government not adopted these tax cuts, it could instead have doubled its support for healthcare, post-secondary education, and social assistance. This point would be worth remembering next time someone claims that medicare is inherently unsustainable.

The 2007 Public Accounts (page 1.7 of Volume I) indicate that the combined annual expenditure of all federal departments (excluding National Defence and transfer payments) was $40.3 billion. Of course, this figure will probably be higher in 2012-13. Nevertheless, it is striking that the tax cuts will cost as much as it currently costs to run the Government of Canada’s entire non-military side.

Table 2.3 (page 47) of the Statement indicates that federal revenues will be $288.9 billion in 2012-13. The implication is that, without the tax cuts, federal revenues would have been $329.1 billion.

Put another way, the Conservatives have surrendered 12.2% (or nearly one-eight) of future federal revenues during their two years in office.

Given another decade and a half at this rate, the Canadian state would disappear altogether.

You can argue all you want about which pocket the tax cuts came out of. The bottom line is that we HAD a surplus, they gave it to the rich - again - and vital defense spending (aka Harper's bullshit promises) go un-funded or cancelled.

Get YOUR head out of Harper's lying ass and then get YOUR facts straight.

... and thanks for playing